Your First 100 Days After DPIIT Recognition: A Roadmap for Startup Success

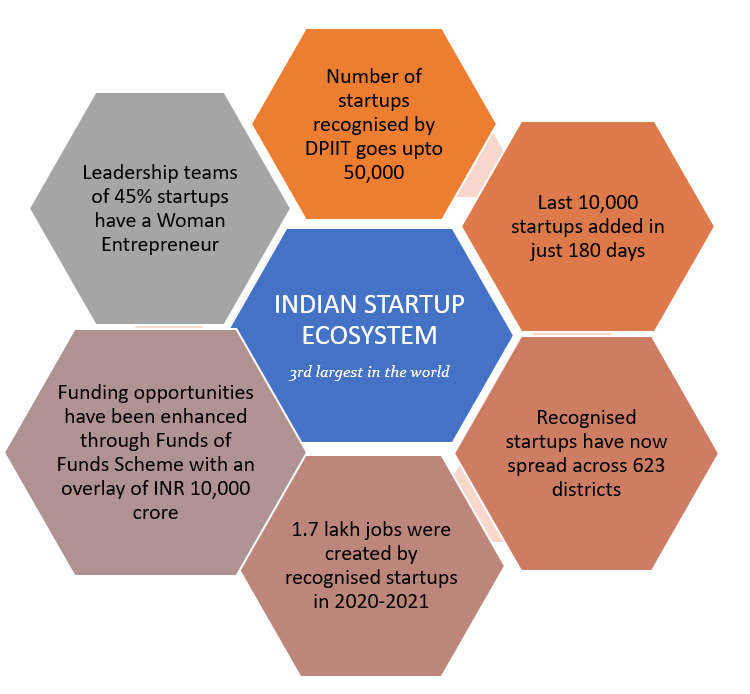

DPIIT (Department for Promotion of Industry and Internal Trade) recognition is a game-changer for Indian startups, validating their innovation and unlocking a suite of benefits, from tax exemptions to funding opportunities. However, the first 100 days post-recognition are critical for leveraging these advantages to build a scalable, sustainable business. This article provides a actionable roadmap […]

Your First 100 Days After DPIIT Recognition: A Roadmap for Startup Success Read More »