Gold has been a standout performer, soaring over 20% annually in 2023 and 2024, and already up 27% in 2025, hitting a record $3,500 per ounce on April 22. This rally, doubling prices in under 30 months, has been fueled by geopolitical tensions and a weakening US dollar. With the dollar index dropping 12% to a multi-year low of 96 in 2025, gold’s allure as a safe-haven asset is stronger than ever. But how exactly does the dollar’s performance affect gold prices, and what’s next for gold in India and globally? Let’s break it down.

The Inverse Relationship: Gold and the US Dollar

Gold and the US dollar share a well-documented inverse relationship. When the dollar weakens, gold prices tend to rise, and vice versa. This dynamic stems from gold being priced in dollars globally, making it more affordable for international buyers when the dollar loses value.

How the Dollar Index Works

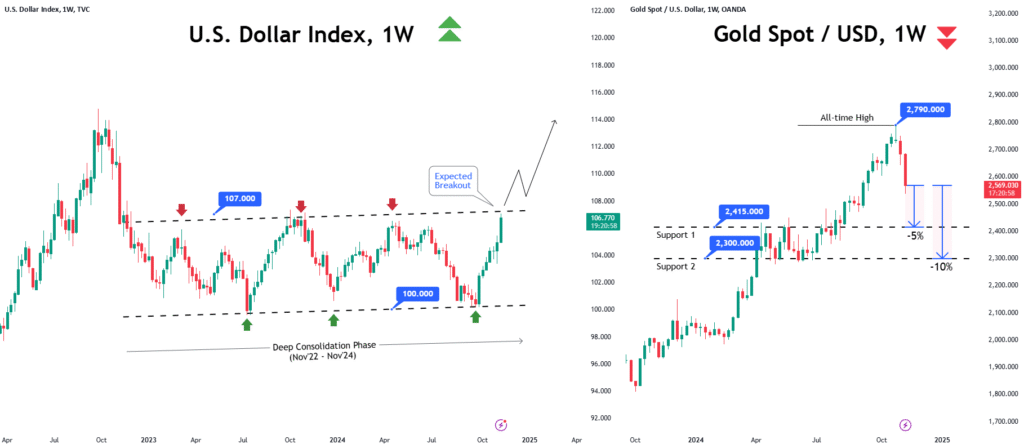

The dollar index (DXY) measures the US dollar’s strength against a basket of six major currencies (e.g., euro, yen, pound). A falling DXY signals a weaker dollar, boosting demand for dollar-denominated assets like gold. For example:

- If the USD-INR exchange rate rises from ₹85 to ₹90, the Indian rupee weakens, and the dollar strengthens, often pushing gold prices down.

- If the rate drops to ₹80, the rupee strengthens, the dollar weakens, and gold prices typically rise as investors seek alternatives.

In 2025, the DXY’s 12% decline has made gold more attractive, driving its price surge.

Why Is the US Dollar Weakening in 2025?

Several factors are pressuring the dollar:

- Trade Wars and Tariffs: Post-2024 US elections, reciprocal tariffs under President Trump have sparked fears of currency wars. Trade tensions, particularly with China, threaten the dollar’s dominance, as seen in its drop from a high of 109 in November 2024 to 96 in 2025.

- US Federal Reserve Uncertainty: Trump’s push for aggressive rate cuts and speculation about replacing Fed Chair Powell have raised concerns about the Fed’s independence, eroding confidence in the dollar.

- Rising US Debt: The US debt-to-GDP ratio stands at 123%, with national debt at $35.46 trillion against a $28.83 trillion GDP. Trump’s proposed tax bill could add $3.9 trillion, increasing borrowing costs. Interest payments already consume 16% of federal spending in 2025, and Moody’s downgrade of the US credit rating signals further trouble.

- Declining Trust in US Treasuries: Global investors, including central banks in Japan and China, are reducing exposure to US bonds to avoid losses from a weakening dollar, further pressuring the DXY.

How a Weak Dollar Boosts Gold

A declining dollar makes gold, a dollar-denominated commodity, cheaper for non-US investors, increasing demand. Investors also shift from dollar-based assets (e.g., Treasuries) to gold to preserve value, especially during economic uncertainty. Central banks, which added 1,037 tons of gold to reserves in 2024 (World Gold Council), continue buying in 2025, albeit at a slower pace, reinforcing gold’s safe-haven status.

For example, if a fund manager in India holds dollar-based assets and the DXY falls, they may redirect funds to gold to hedge against currency depreciation. This demand pushes gold prices higher. In India, gold’s appeal is amplified by cultural affinity and its role as an inflation hedge, with prices reaching ₹97,220 per 10 grams of 24-karat gold as of July 2025.

Gold in India: The Road Ahead

In India, gold prices are nearing ₹1 lakh per 10 grams, driven by global trends and a weaker rupee (USD-INR at ₹85). Key factors influencing gold’s trajectory:

- Geopolitical Stability: Easing tensions (e.g., Russia-Ukraine, Israel-Iran) may reduce gold’s safe-haven appeal, stabilizing prices around $3,350 globally and ₹95,000–₹98,000 in India.

- Central Bank Buying: Continued purchases, though slower, support demand. India’s RBI added 40 tons in 2024, per World Gold Council.

- Dollar Volatility: Further DXY declines could push gold toward $3,800 globally and ₹1.05 lakh in India by mid-2026, assuming USD-INR hits ₹87.

- Trade and Currency Wars: Escalating tariffs or currency devaluations could sustain gold’s rally.

However, risks remain:

- A stronger-than-expected dollar (e.g., due to Fed tightening) could cap gold’s gains.

- Domestic import duties (12.5% in India) and taxes may dampen retail demand.

Conclusion

The US dollar’s 12% decline in 2025, driven by trade wars, debt concerns, and Fed uncertainty, has propelled gold’s 27% surge, reinforcing its role as a safe-haven asset. As the dollar weakens, investors globally and in India are flocking to gold to preserve wealth. While prices may hover near ₹97,220 per 10 grams in India, further dollar weakness could push gold past ₹1 lakh soon. Investors should weigh geopolitical and economic factors, consult financial advisors, and diversify portfolios to navigate this rally cautiously.

Disclaimer: The views expressed are for educational purposes and do not constitute investment advice. Consult a registered financial advisor before investing.