India’s startup ecosystem, with over 1.74 lakh recognized startups as of April 30, 2025, is a global powerhouse, spanning DeepTech, AgriTech, SpaceTech, and more. The Startup India Portal, launched under the Startup India initiative, is a one-stop digital platform that democratizes access to regulatory support, funding, learning resources, and growth opportunities. This guide outlines how founders, especially in non-metro regions or navigating compliance for the first time, can strategically use the portal to register, secure DPIIT recognition, and drive scalable growth.

Why the Startup India Portal Matters

The Startup India Portal is more than a registration gateway—it’s a catalyst for startups to access government-backed benefits, connect with investors, and streamline operations. With over 1,800 incubators, 1,200+ funding deals, and ₹1,200 crore in GeM orders for startups in 2024, the portal empowers founders to build resilient ventures. Whether you’re seeking tax exemptions, funding, or market access, the portal consolidates resources to accelerate your journey from ideation to impact.

Step 1: Register on the Startup India Portal

Registration is the entry point to the Startup India ecosystem, establishing your legitimacy and unlocking access to programs like DPIIT recognition and funding schemes.

Steps to Register:

- Visit the Startup India Portal (www.startupindia.gov.in).

- Click “Register” to redirect to the BHASKAR (Bharat Startup Knowledge Access Registry) portal.

- Fill in details: first name, last name, email ID, nationality, and mobile number to generate a unique BHASKAR ID.

- Log in to the Startup India Portal with your BHASKAR ID, complete the profile (business name, address, sector), and submit.

- Set up a password and verify via OTP sent to your registered email or phone.

- Access your personalized dashboard to explore resources and apply for benefits.

Tip: Ensure accurate details, as these are cross-verified during DPIIT recognition. Registration takes 10–15 minutes and is free.

Step 2: Secure DPIIT Recognition

DPIIT recognition validates your startup’s innovation and scalability, unlocking tax exemptions, funding eligibility, and regulatory relaxations. As of April 2025, 1.74 lakh startups have received certificates, though some are canceled or expired.

Benefits of DPIIT Recognition:

- Tax Exemptions: 100% income tax deduction under Section 80-IAC for three consecutive years (requires Inter-Ministerial Board approval).

- Angel Tax Relief: Exemption from Section 56(2)(viib) for investments above fair market value.

- Compliance Ease: Self-certification for nine labor and three environmental laws for up to five years, reducing inspections.

- IP Support: Fast-track patent/trademark applications with up to 80% fee rebates.

- Public Procurement: Access to Government e-Marketplace (GeM) without prior turnover or experience requirements.

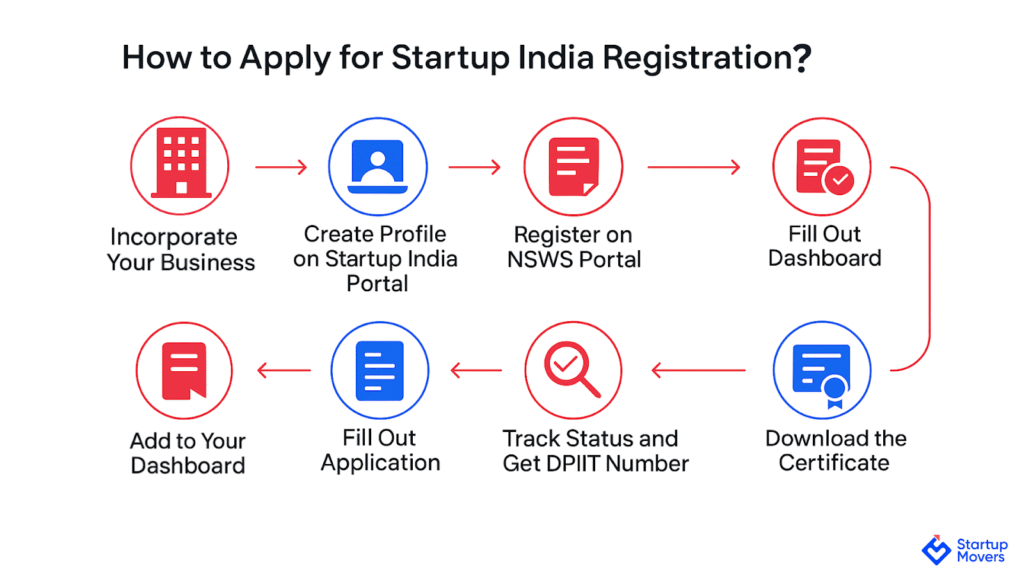

Application Process:

- Log in to your Startup India dashboard and navigate to the “Get Recognised” section.

- Complete the application form, detailing your startup’s innovation, scalability, and business model (e.g., unique technology or market disruption).

- Upload documents: Certificate of Incorporation, PAN, pitch deck, and proof of innovation (e.g., patent or product description).

- Submit for DPIIT review. Approval typically takes 30–60 days, with 85% of applications processed within 45 days in 2024.

Tip: Highlight your startup’s unique value proposition. For example, a fintech startup might emphasize blockchain-based solutions to stand out.

Step 3: Access Funding Schemes

DPIIT-recognized startups gain priority for government-backed funding, critical for scaling operations.

Key Schemes:

- Startup India Seed Fund Scheme (SISFS): Up to ₹50 lakh in grants or ₹5 crore in equity/debt for proof-of-concept, prototyping, or market entry. In 2024, SISFS disbursed ₹600 crore to 2,000+ startups.

- Fund of Funds for Startups (FFS): Managed by SIDBI, it allocates ₹10,000 crore to SEBI-registered VCs, which invest in startups (e.g., ₹50 crore to Blume Ventures in 2024).

- Credit Guarantee Scheme for Startups (CGSS): Collateral-free loans up to ₹10 crore via banks like SBI or HDFC, with 80% government-backed guarantees.

Actions:

- Update your pitch deck and financial projections to reflect DPIIT status.

- Apply for SISFS or CGSS via the portal’s funding section, ensuring compliance with eligibility (e.g., less than 10 years old, ₹100 crore turnover cap).

- Connect with VCs or angel networks (e.g., Mumbai Angels) through Startup India’s Investor Connect events.

- Engage a financial advisor to streamline applications and ensure audit-ready documentation.

Example: A Gurugram-based edtech startup secured ₹30 lakh via SISFS within 90 days of DPIIT recognition, using funds for app development.

Step 4: Leverage Learning and Development Tools

The portal offers curated resources to build business acumen and operational skills.

Resources:

- Learning Modules: Courses on fundraising, compliance, marketing, and product development (e.g., “How to Pitch to VCs”).

- Templates: Ready-to-use shareholder agreements, term sheets, and pitch decks, downloaded by 50,000+ startups in 2024.

- Webinars and Masterclasses: Weekly sessions by experts like Anupam Mittal or Kunal Shah, offering insights on scaling and innovation.

Actions:

- Enroll in courses via the portal’s “Learning” section to address skill gaps (e.g., legal compliance for SaaS startups).

- Download templates to standardize contracts and investor pitches.

- Attend virtual or in-person events listed on the portal to network with mentors and peers.

Step 5: Stay Compliant and Informed

DPIIT recognition simplifies compliance, but staying proactive is key.

Features:

- Self-Certification: File compliance for labor (e.g., Shops Act) and environmental laws via the portal, avoiding inspections for five years.

- Tracking Tools: Monitor application statuses (e.g., DPIIT recognition, SISFS) and receive policy updates.

- Grievance Redressal: Address issues like delayed approvals through the portal’s support desk.

Actions:

- Submit self-certification forms annually to maintain compliance benefits.

- Use the dashboard to track funding or IP application statuses.

- Subscribe to Startup India newsletters for policy changes (e.g., new tax exemptions).

Step 6: Tap into Market Access via GeM

GeM offers DPIIT startups a direct channel to sell to government entities, with ₹1,200 crore in orders secured in 2024.

Actions:

- Register as a seller on GeM via the Startup India Portal’s integration link.

- List products/services aligned with government needs (e.g., IT solutions for e-Governance).

- Ensure competitive pricing and quality to win bids.

Example: A Hyderabad-based AI startup secured a ₹5 crore GeM contract for smart city analytics within 100 days of DPIIT recognition.

Challenges and Tips

- Application Delays: DPIIT recognition can take 30–60 days; ensure complete documentation to avoid rejections (10% of applications rejected in 2024 due to incomplete forms).

- Funding Competition: SISFS is competitive; tailor pitches to highlight innovation and scalability.

- GeM Onboarding: New sellers may face delays; work with GeM facilitators via Startup India Hub.

- Tip: Engage mentors from incubators like T-Hub early to refine applications and strategies.

Conclusion

The Startup India Portal is a powerful tool for founders to transform ideas into scalable ventures. By registering, securing DPIIT recognition, accessing funding, leveraging learning resources, staying compliant, and tapping GeM, startups can unlock growth opportunities. Start by registering on the portal today, apply for DPIIT recognition within 30 days, and engage with incubators and funding schemes within 100 days. Consult legal and financial advisors to navigate compliance and maximize benefits. The portal is your gateway to India’s vibrant startup ecosystem—use it to build a future-ready business.

Disclaimer: This article is for educational purposes and does not constitute financial or legal advice. Verify details with Startup India or DPIIT and consult certified advisors.